Team-Led Triumphs: Pioneering Service Transformation Strategies

One of the key challenges confronting manufacturers today, as they embark on their service transformation journey, is building strong service...

9 min read

Jan van Veen

Feb 27, 2025 10:22:05 AM

To achieve sustained growth, service leaders must go beyond common trends and develop strategies rooted in structured growth patterns, unique industry insights, and an evaluation of viable service business models in their industry.

AI-driven services, predictive maintenance, remote services, and outcome-based services are positioned as the next major revenue drivers for service businesses. Companies across industries anticipate that these innovations will transform their business models and unlock new growth opportunities.

However, most service businesses fail to achieve the expected revenue impact and may not experience sustained growth.

The reason? Following industry trends is not the same as having a growth strategy.

Many companies focus on new service models without questioning whether they fit their specific market, customers, and competitive landscape. They invest in the same ideas as their competitors but lack the strategic depth to make them work. As a result, they end up competing in crowded markets, launching services with limited demand, or struggling to scale their offerings.

Many service businesses follow the same playbook for their service strategies and innovation. AI-driven uptime, predictive maintenance, and outcome-based services have become the default growth strategies. These models dominate industry discussions, investor presentations, and transformation roadmaps.

While these innovations are likely essential, the reality often shows a lack of ongoing growth.

🚨 Staying Within the Industry's "Currency" Limits Growth – Each industry operates on a well-established "currency"—the expected annual improvement in performance or cost reduction (e.g., fuel efficiency in logistics, uptime in manufacturing, energy savings in utilities). While meeting these expectations is necessary to sustain competitiveness, it does not create growth. If a new service only delivers the industry’s standard rate of improvement, it merely preserves existing business rather than expanding it. True growth comes from going beyond these baseline expectations—helping customers solve bigger, more strategic challenges that unlock new value, revenue streams, or competitive advantages.

🚨 The Commodity Trap – No Differentiation, No Pricing Power – When every competitor is offering the same AI-driven uptime service, predictive maintenance contract, or performance-based pricing model, differentiation disappears. If all players are following the same trend, nobody has a real advantage. This drives services toward price-based competition, eroding margins and making it harder to sustain profitability. Customers, in turn, start treating these services as commodities rather than high-value differentiators, limiting pricing power and making it difficult to scale profitably.

🚨 New Solutions Are Solving the Wrong Problems, the Wrong Way – Too often, service businesses design offerings based on what technology enables rather than what customers actually need. AI, predictive maintenance, and servitization models may be technically sophisticated, but if they fail to solve the bigger business challenges customers prioritise, they won’t gain traction. Customers don’t just want "fewer failures"—they want to optimise production output, extend asset life, or simplify operations. If a solution requires customers to change the way they work without addressing their strategic pain points, adoption will be slow or nonexistent.

The reason these challenges persist is not that AI, predictive maintenance, or servitization are inherently flawed; it’s that companies fail to develop the deep, unique strategic insights needed to make them work. The companies that struggle the most tend to overlook three critical areas:

🔍 Key Question: Is the new service model just a different way to charge, or does it actually create more value?

Advanced service models often promise higher uptime, better efficiency, and cost predictability. But if the benefits don’t go beyond the industry’s standard annual improvements, customers may see them as unnecessary complexity rather than true business enablers.

✅ When It Works:

❌ When It Fails:

Example: Outcome-based contracts sound compelling, but if customers already have internal maintenance capabilities and cost control, they may not want to pay a premium for a service they can handle themselves.

🔍 Key Question: Do customers actually want a fully managed service, or do they prefer to control certain aspects themselves?

Not all customers want an "everything-as-a-service" model. Companies must assess:

✅ When It Works:

❌ When It Fails:

Example: Many manufacturers assume customers want fully managed predictive maintenance, but some prefer just the insights, keeping maintenance decisions in-house (DIWM). Forcing them into a DIFM model creates resistance.

🔍 Key Question: Are customers looking for a single provider to manage multiple services and equipment, or do they prefer working with multiple specialists?

Many advanced service models fail because they assume customers want a single provider to integrate and manage everything. But in reality:

✅ When It Works:

❌ When It Fails:

Example: Some manufacturers offer full-service asset management, assuming customers want a single point of contact. However, if customers have strong relationships with multiple suppliers, they may resist giving one provider too much control.

🚨 Lost Investments – Millions wasted on new services and solutions that fail to deliver value.

🚨 Margin Erosion – Competing in Red Oceans instead of creating a strategic advantage

🚨 Slow Customer Adoption – Services that fail to attract or retain customers

To achieve sustained service growth, companies must:

New technology or new service models alone will not drive growth. In reality, growth comes from understanding the forces shaping the industry and aligning services with those fundamental shifts.

Before investing in new services, companies must first analyse the external forces shaping demand, adoption, and competition:

The Challenge: Traditional truck manufacturers concentrated on vehicle sales, but MAN Trucks recognised that truck buyers had a substantial opportunity to lower their operating costs.

🔍 Strategic Insight: MAN Trucks analysed fleet operators' real cost drivers—fuel consumption, tire wear, and downtime. They found that fuel costs over a truck’s lifecycle far exceeded the cost of the truck itself.

💡 Solution: Instead of just selling trucks, MAN Trucks introduced Telematics for Fuel Efficiency, an AI-powered system that monitors fuel consumption and driver behavior, providing fleet owners with full transparency into operational efficiency. The system not only tracks how trucks are driven but also offers data-driven training recommendations to help drivers improve fuel efficiency, reduce wear and tear, and lower overall operating costs.

🎯 Impact

✅ Created a service that directly impacted customers' bottom line.

✅ Aligned service strategy with a clear market driver (operating cost reduction).

✅ Developed a sticky, data-driven service that increased long-term customer retention and recurring revenue.

👉 Takeaway: The most successful service businesses don’t just add digital services—they align them with clear, measurable customer priorities.

Strategic insights are not enough—companies need to translate them into a clear service strategy. This means understanding:

Many service businesses fail because they expand without understanding market positioning, competitive intensity, or scalability. To avoid this, they must apply structured growth frameworks rather than relying on gut feeling.

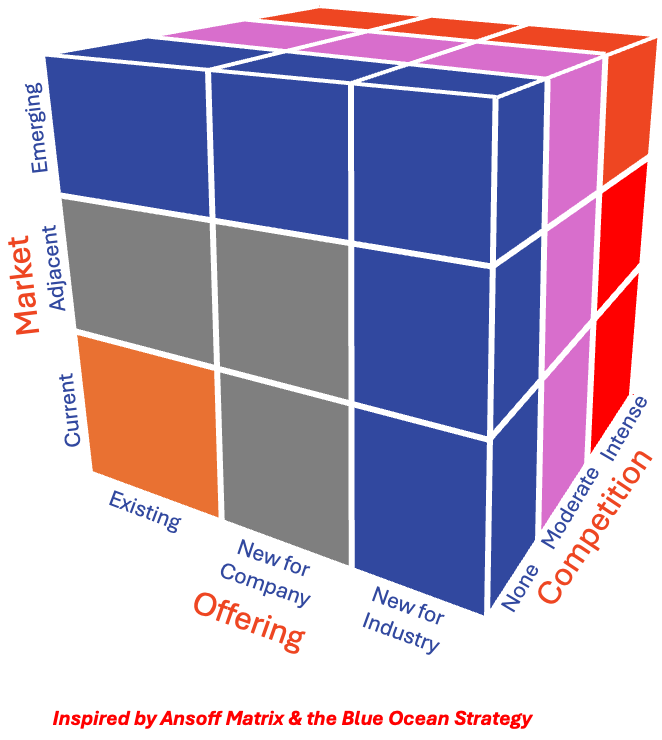

Successful companies use proven frameworks to ensure they are moving in the right direction:

🔨 The Challenge: Hilti, a leading manufacturer of construction tools, operated in a highly competitive, price-sensitive market where tool manufacturers struggled to differentiate.

🔍 Strategic Insight: Instead of focusing on selling tools, Hilti studied the real pain points of construction companies:

💡 Solution: Instead of competing on product price (Red Ocean), Hilti created a Blue Ocean by introducing a Fleet Management service.

🎯 Impact:

✅ Created a high-margin, recurring revenue service in a previously commoditised market.

✅ Strengthened customer relationships and increased retention.

✅ Built long-term differentiation that competitors struggled to replicate.

👉 Takeaway: Hilti didn’t just “sell a subscription”—it restructured how customers engaged with its products, solving a bigger operational challenge.

Even with strong strategic insights and structured growth planning, a service strategy will fail if the business model does not meet customer needs.

Many companies struggle because they choose the wrong revenue model for their market conditions, industry maturity, or competitive position.

To ensure viability, service businesses must consider:

✅ What problem are you solving?

Is the service addressing a high-priority business challenge for the customer?

✅ What do customers prefer to own vs. outsource?

If a function is mission-critical, customers may prefer to keep it in-house rather than outsource it.

✅ How complex or unfamiliar is the service?

The more complex the solution, the harder it will be for customers to adopt.

✅ How close to the customer’s core operations is your service?

Services closer to mission-critical processes require greater trust and deeper integration.

✅ Is the solution niche or end-to-end?

Some customers want highly specialised services, while others prefer integrated, all-in-one solutions.

⚙️ The Challenge: Siemens initially launched MindSphere as an open industrial IoT platform, expecting widespread adoption across manufacturing.

🔍 Strategic Misalignment: While the idea was strong, Siemens faced challenges:

💡 Solution: Siemens repositioned the platform as Insights Hub, narrowing its focus to specific, high-value industrial applications rather than a universal IoT solution.

🎯 Impact:

✅ More targeted, high-value use cases improved customer adoption.

✅ A clearer business model made it easier to monetise.

✅ Focusing on real customer needs increased trust and long-term engagement.

👉 Takeaway: A great technology platform isn’t enough—it needs a clear business model and use case that aligns with industry realities.

🚨 Why service businesses fail:

🚀 What successful companies do differently:

✅ Develop deep insights into market dynamics, customer needs, and competition.

✅ Structure growth with proven frameworks like the Ansoff Matrix and Blue Ocean Strategy.

✅ Align business models with customer priorities to create scalable, high-value services.

💡 Final Thought: Growth doesn’t come from following industry trends—it comes from systematically designing the right strategy, structure, and business model.

The challenges of service growth are complex, but the right strategy can set you apart. Adopting AI, predictive maintenance, or servitization won’t drive growth unless these models align with industry realities, customer priorities, and a structured execution plan.

🔍 Want to go deeper? Join us at the Service Transformation Summit on Driving Growth with Next-Generation Service Models, where we’ll explore:

✅ How to sharpen your service strategy using a structured, three-layered approach.

✅ How leading manufacturers design next-generation service models that deliver real customer value and sustained profitability.

✅ How to break free from the commodity trap and create service offerings that differentiate and scale.

🚀 This is your opportunity to gain actionable insights, learn from industry leaders, and refine your approach to service growth.

👉 Check it out and register now

Amsterdam: April 30 - May 1, 2025

Chicago: May 14-15, 2025

Singapore: May 28-29, 2025

Check out the upcoming Service Transformation Summits:

Subscribe for the our Impulse Letter

With regular updates about service news, trends and best practices.

One of the key challenges confronting manufacturers today, as they embark on their service transformation journey, is building strong service...

Drive growth by solving emerging customer needs, while enhancing existing The service landscape for B2B manufacturers is evolving rapidly. While many...

In a dynamic business landscape like in services for manufacturing companies, strategic thinking is a necessity. Cultivating this skill across all...