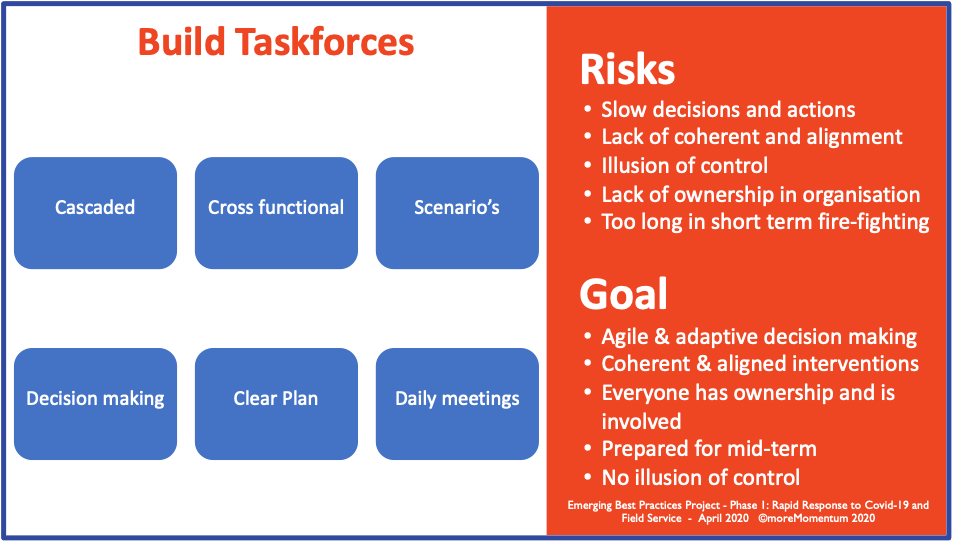

Build Taskforces during Covid-19

In a crisis like the COVID-19 outbreak, and especially during Phase 1 – Rapid Response, the speed and criticality of developments and decisions to be...

During a crisis, one of the biggest threats for companies is going bankrupt due to lack of cash to cover the immediate expenses. This bankruptcy can be immediate or the result of a downward spiral process, in which activities must be gradually stopped due to lack of cash, leading to a decrease of revenue and cash-inflow.

In times of crisis, not only activities and operations are different from business-as-usual, also the way we manage our organisation and teams, as well as the way we take decisions and execute them will change.

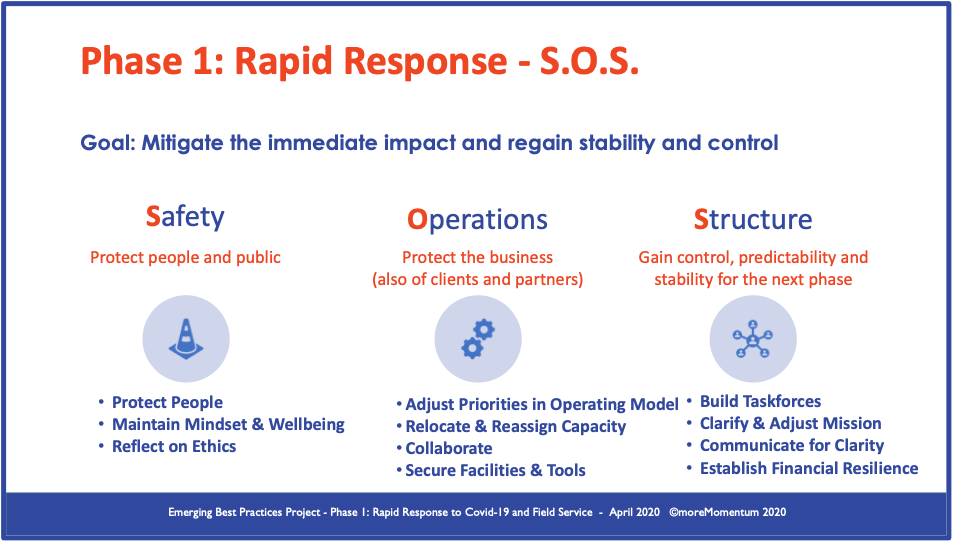

This is one of the 3 main sections from the "Ultimate Guide for Phase 1 - Rapid Response to Mitigate the Immediate Impact of Covid"

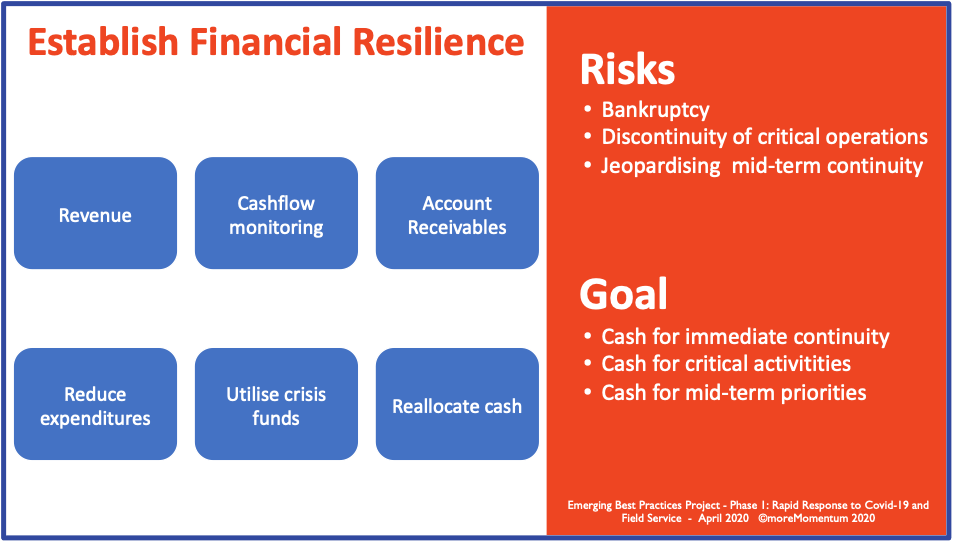

Regarding Establish Financial Resilience:

Risks to address

Goal

Main aspects

Revenue

Many manufactures are experiencing or risk a drop in revenue. Clients are delaying new investments and, in many areas, also service revenues have dropped.

We also see some cases where service departments and providers drop prices or even provide (adjusted) services free of charge. However sympathetic this may look, you should try to avoid this and find ways to secure revenue and cash inflow.

Some practices we see are;

Cashflow monitoring

Managing cashflow and securing cash for continuity is critical;

Accounts Receivable

We all see the first companies going bankrupt or delaying payments. To minimise the impact of this on your business, it pays to;

Reduce expenditures

In a real crisis-situation, rigorous cost management is essential. Particularly discretionary overhead and other indirect cost should be reconsidered;

Most companies try to avoid layoffs for cost cutting. You want to avoid losing talents which required significant investment to attract and develop and to lose capacity to recover and scale up your business if the restrictive measures are being relieved again.

Governments of many countries have installed funds to help companies cover costs of inactive labour.

In Phase 2 of the crisis – Review & Outlook, you can take further decisions what investments to further delay, continue or even intensify, after reviewing the investment portfolio.

Utilise crisis funds

With the aim to minimise the economic impact of this health-crisis, many governments are installing various funds and financial measures to support companies. In order to benefit;

Reallocate cash

Due to the crisis and adjusted ways of working, we also see some shifts in expenses and budgets. Flexibility to adjust focus of procurement is important to allow the crisis operations to function.

Download the full Guide for Phase 1 - Rapid Response

Subscribe for the our Impulse Letter

With regular updates about service news, trends and best practices.

In a crisis like the COVID-19 outbreak, and especially during Phase 1 – Rapid Response, the speed and criticality of developments and decisions to be...

The biggest mistake we can make is being stuck in business-as-usual and operational thinking. The big opportunity to thrive during and after this...

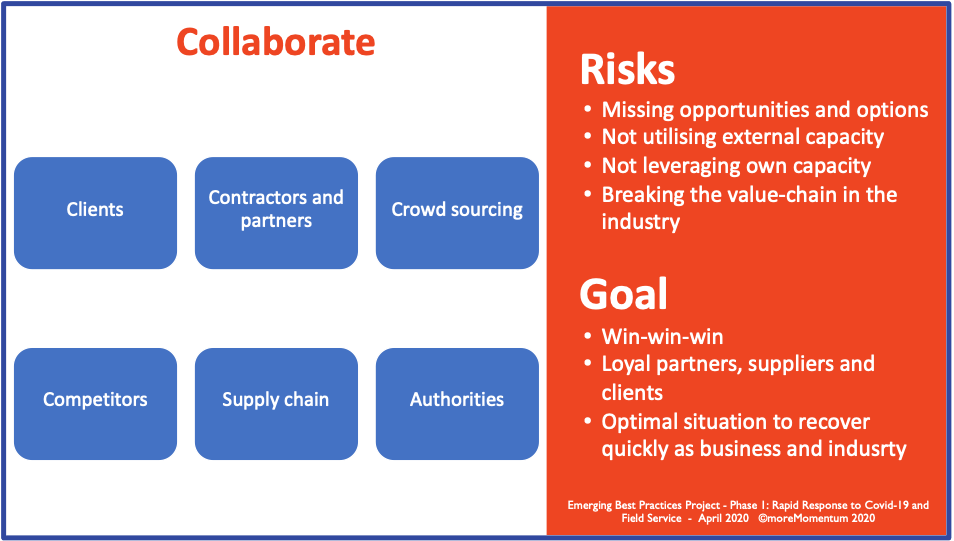

In times of crises, we are all in the same boat to survive and thrive. You may need to collaborate with parties you normally would not collaborate...